ArmInfo. Armenian banks have chosen to solve the problem of bad debts (NPL) by refinancing problem loans, which, although it makes it possible to avoid write-offs and, consequently, increase profits without difficulty, but the recovery of the loan portfolio in this way is short-lived.

And why?

Because an insolvent and unscrupulous borrower is unlikely to turn into a trustworthy client by the will of the wand. So it turns out that banks, by refinancing only for a certain period, save profits from subsidence and delay the root solution of problems with debts on toxic loans.

And if until 2018 only single banks resorted to this method of reprisals with the NPL, then with the change of power in Armenia, the process was sharply intensified and took on a large scale. The July call of new Government for the amnesty of fines and penalties on bad loans served as an impetus, which the banks started to fulfill immediately, with the market leaders in the loan portfolio pioneering - Ameriabank, ACBA-Credit Agricole Bank, Ardshinbank.

On the one hand, this gave the refinancing of problem loans a large scale, and on the other hand, it allowed banks to at least temporarily free themselves from the burden of non-performing assets.

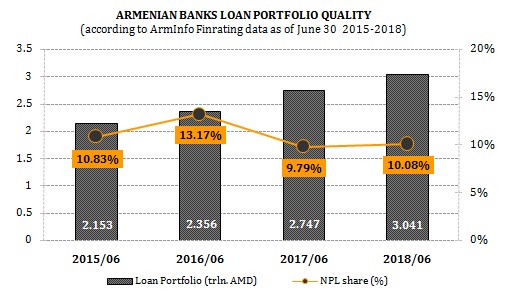

Armenian Banks Loan Portfolio Quality

(according to ArmInfo FinRating data)

|

Banks |

Loan Portfolio |

Loans with overdues more than 90 days |

|||||

|

01.07.18 (bln.AMD.) |

01.07.17 (bln.AMD.) |

Annual up/down |

01.07.18 (bln.AMD.) |

01.07.17 (bln.AMD.) |

Annual up/down |

Доля в портфеле |

|

|

TOTAL BS RA |

3 040,9 |

2747,2 |

10,69% |

123,9 |

224,3 |

-44,76% |

4,07% |

|

Armbusinessbank |

385,1 |

287,6 |

33,89% |

2,4 |

1,9 |

26,32% |

0,62% |

|

Ameriabank |

495,3 |

419,9 |

17,94% |

7,1 |

9,9 |

-28,28% |

1,43% |

|

EVOCABANK |

72,9 |

52,1 |

39,99% |

1,4 |

1,3 |

7,69% |

1,92% |

|

Ardshinbank |

460,8 |

361,6 |

27,42% |

11,8 |

5,3 |

122,64% |

2,56% |

|

ArmSwissbank |

68,3 |

58,1 |

17,63% |

1,9 |

0,962 |

97,51% |

2,78% |

|

Converse Bank |

175,2 |

142,4 |

23,04% |

6,4 |

2,9 |

120,69% |

3,65% |

|

IDBank |

75,0 |

252,1 |

-70,23% |

3,4 |

4,5 |

-24,44% |

4,53% |

|

Armeconombank |

131,5 |

99,6 |

31,93% |

6,3 |

6,7 |

-5,97% |

4,79% |

|

INECOBANK |

194, 9 |

173,7 |

12,27% |

9,9 |

9,4 |

5,32% |

5,08% |

|

ARARATBANK |

128,6 |

122,2 |

5,20% |

11,03 |

12,1 |

-8,84% |

8,58% |

|

Byblos Bank Armenia* |

50,0 |

42,3 |

18,16% |

6,8 |

4,1 |

65,85% |

13,60% |

|

HSBC Bank Armenia* |

143,9 |

139,98 |

2,77% |

21,8 |

36,01 |

-39,46% |

15,15% |

|

Artsakhbank |

75,8 |

68,1 |

11,21% |

11,9 |

16,9 |

-29,59% |

15,70% |

|

ACBA-Credit Agricole* |

225,5 |

211,8 |

6,49% |

39,8 |

43,4 |

-8,29% |

17,65% |

|

Bank VTB (Armenia)* |

176,3 |

172,8 |

1,99% |

33,3 |

41,2 |

-19,17% |

18,89% |

|

Unibank |

158,3 |

135,6 |

16,74% |

66,8 |

27,9 |

139,43% |

42,20% |

|

Mellat Bank* |

23,6 |

7,2 |

227,38% |

н/д |

н/д |

н/д |

н/д |

|

According to financial reports of Armenian banks |

|||||||

| Finport.am | |||||||

*These five banks are subsidiaries of foreign banking entities

Given that the large-scale refinancing process started in July, its first results will be visible in the third quarter. And in anticipation of this, the NPL dynamics showed a marked increase. Thus, the volume of NPL by July 1, 2018 compared with the same period of 2017 accelerated growth from 2.4% to 14%, which, however, was significantly inferior to the growth of two and three years ago - 37% and 54.5%, respectively. It was suspended due to an urgent increase in the level of capitalization of banks in accordance with the regulatory capital requirement (min. 30 billion drams since 2017).

It is noteworthy that NPL, on the contrary, overdue over 90 days - and these are the most dangerous loans - decreased by 44.8% per year due to a significant decline in a doubtful group (3 times) and hopeless (2 times) mainly due to write-offs from balances. This was accompanied by a 43% growth in controlled loans.

As a result, the share of NPL in the loan portfolio reached 10.1% by July 1, 2018, which is slightly higher than a year ago (9.8%), but less than two years ago (13.2%). Only for overdue over 90 days (non-standard, doubtful, hopeless) the share of NPL in the loan portfolio as of July 1, 2018 was 4.1%, which is significantly lower than in previous years: 8.2% - as of July 1, 2017, 11.2% - on July 1, 2016 Of the total NPL, over 47% accumulated in a hopeless group of loans, against 58.1% a year earlier (the highest level in the last 5 years). A sharp reduction in the volume of bad loans was preceded by a sharp slowdown in growth recorded from the previous two years, from 2.2 times to 6.7%.

The structure of NPL shows that banks mainly suffer from a sharp increase in consumer lending (by 22.4%), after their capitalization, which led to the need to revitalize retail credit policy. Thus, consumer loans formed the largest share of NPL (2.3%), followed by toxic loans for loans to the agricultural sector (1.5%), trade (1.3%) and industry (1.2%). It is noteworthy that recently the greatest dynamics of growth of non-returns comes from such actively developing sectors of the economy as catering and services. Their financing by July 1, 2018 increased by 30.2% per annum, but the growth in non-returns was much more impressive - almost 3 times. This is followed by the agricultural sector - NPL growth by 33%, consumer loans - by 22%, construction sector - by 18%, industrial sector - by 12%, trade - by 3%.

The picture on the banking structure of the NPL shows a direct connection with the lack of diversification of the loan portfolio. Banks that have concentrated more than 50% of the portfolio in consumer lending turned out to be the most vulnerable, and those who have distinguished themselves by healthy diversification of investments have hardly suffered.

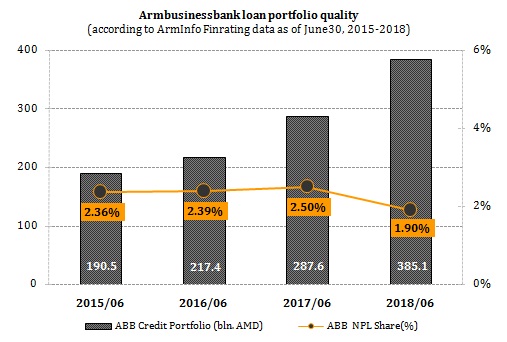

So, the smallest share of NPL in the loan portfolio as of July 1, 2018 was distinguished in Armbusinessbank - 1.9% (only for overdue over 90 days - 0.6%), who managed to keep the quality of the portfolio in annual terms at the same healthy level. Nevertheless, most of the NPL of Armbusinessbank is focused on consumer loans, and comparatively less in the construction industry, the agricultural sector, and industry. At the same time, Armbusinessbank managed to increase its total loan portfolio by 34% over the year, due to which the income from lending increased by 28.1%, reaching 59% in total revenues. As a result, Armbusinessbank's net profit increased by more than 2 times, and this increase mainly fell in the II quarter.

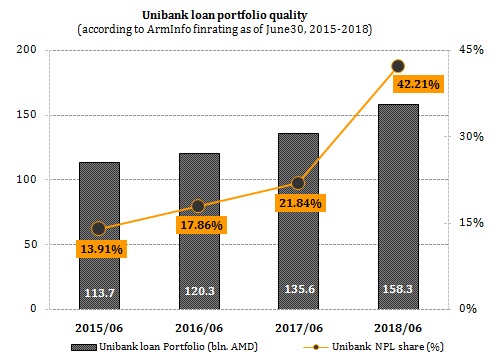

Meanwhile, the highest level of “toxic” loans was at Unibank - 42.2%, almost completely concentrated on overdue over 90 days with the dominance of high-risk loans, which increased several times. This indicator significantly exceeds the upper threshold of the international critical limit (15%). Moreover, in Unibank, the bulk of NPL sat down in consumer loans and loans to the trade sector, and the rest is relatively smaller in the areas of public catering and services, the industrial sector and the construction sector. Despite the annual net profit growth, due to the increase in the toxicity of the assets, Unibank “distinguished itself” in the second quarter by a significant decline in the level of profits (by 53.5%).

Thus, despite the fact that at Armbusinessbank and Unibank the main part of NPL has concentrated in consumer loans, nevertheless, this accumulation does not pose a serious threat for Armbusinessbank, since in total credit investments, consumer loans account for only 11%, while Unibank rolls over 50%.

Against the general background, the net profit of the banking system of Armenia in the first half of 2018 to the same period of 2017 increased by 2 times to 36.3 billion drams ($ 75.3 million), but only in the second quarter it decreased by 20.2%.

Lending income slowed annual growth from 11.6% to 0.9%, which reduced the share in total revenues from 64.9% to 59.5%. The return on assets (ROA) increased annually from 0.88% to 1.64%, while the standard level of total liquidity decreased from 36.12% to 31.29% and current liquidity from 225.55% to 187.43% ( with the required minimum of 15% and 60%, respectively).

Thus, analysts concerns that after capitalization, in the face of the need to revitalize the credit policy, the growth of the NPL will resume, turned tu fully justified, however, the further trend in the quality of banks' loan portfolios will largely depend on the level of risk management and ensuring optimal diversification and from the general economic situation in Armenia, the revitalization of the economy and, as a consequence, the increase in the solvent clients. ________________________________

This information requires independent estimates and is not a justification for taking any business or investment decisions.