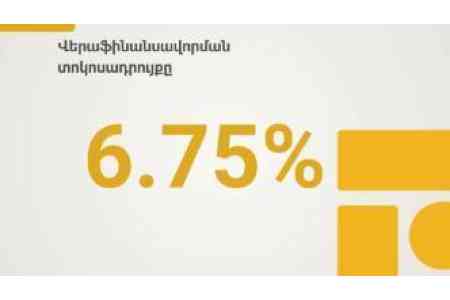

ArmInfo. The Central Bank of Armenia has once again decided to leave the refinancing rate unchanged, setting it at 6.75%. This decision was made on September 16 during a meeting of the Board of the Central Bank of the Republic of Armenia. Accordingly, the rates on Lombard repo is- 8.25% and the interest rate on funds attracted from banks is 5.25%.

In fact, after a decrease in February 2025 by 0.25 percentage points - from 7% to 6.75%, the refinancing rate has remained unchanged.

In total, from mid-2023 to February 2025, the key rate was reduced by 4 percentage points (from the historical maximum of 10.75%). During this period, the rates on Lombard repo and funds attracted from banks also decreased by 4 percentage points, from the maximum of 12.25% and 9.25%, respectively, recorded in December 2022 (and maintained until June 2023). However, the current levels of the refinancing rate, rates on Lombard repo and on funds attracted from banks are far from the minimum levels of 4.25%, 5.75% and 2.75%, respectively, recorded in the second half of 2020. According to statistics, inflation in August 2025 was recorded at 3.6%, compared to 1.3% August 2024 and 0.3% in August 2023. The Central Bank calculated the basic indicator of annual August inflation to be 3.7%, compared to 0,3% a year earlier in the same period.

The detailed rationale for the decision of the Central Bank Council to leave the refinancing rate unchanged will be presented today at 2:00 PM by Martin Galstyan, the Chairman of the Central Bank, during a press conference. The press conference will also be broadcast live on the Central Bank of the Republic of Armenia's YouTube channel and Facebook page.