ArmInfo. In Jan-Sept 2016, the share of retail insurance in the premiums of Armenian insurance companies made up 57.3% (13.6 bln AMD), and the share of corporate insurance was 42.7% (10.1 bln AMD). Retail insurance declined by 0.2% amid 0.9% growth in corporate insurance. Before introduction of motor third party liability insurance (MTPL) and compulsory individual health insurance of state workers, the share of corporate insurance considerably prevailed over the retail one.

Retail insurance prevails in all insurers' portfolios of premiums, but in INGO Armenia the difference between retail and corporate insurance was insignificant. The biggest difference was fixed in RESO - 76.1% and 23.9%, and in Armenia Insurance - 73.1% and 26.9%. In SIL Insurance retail insurance made up 58.8%, Nairi Insurance - 57.7%, Rosgosstrakh Armenia - 55.6%, INGO Armenia - 47.9%.

In the structure of indemnities, the share of payouts to retail customers made up 68.7% or 6.9 bln AMD, and the share of payouts to corporate customers was 31.3% or 3.1 bln AMD. The payouts to legal entities grew by 20%, and those to individuals dropped by 1%.

In the structure of premiums transferred for re-insurance, the share of corporate insurance made up 92.9% or 2.6 bln AMD (10% year-over-year decline), reatil - 7.1% or 198.1 mln AMD (3% year-over-year growth). (On 30 Sept 2016, the AMD/USD exchange rate was 474.46 AMD/1$).

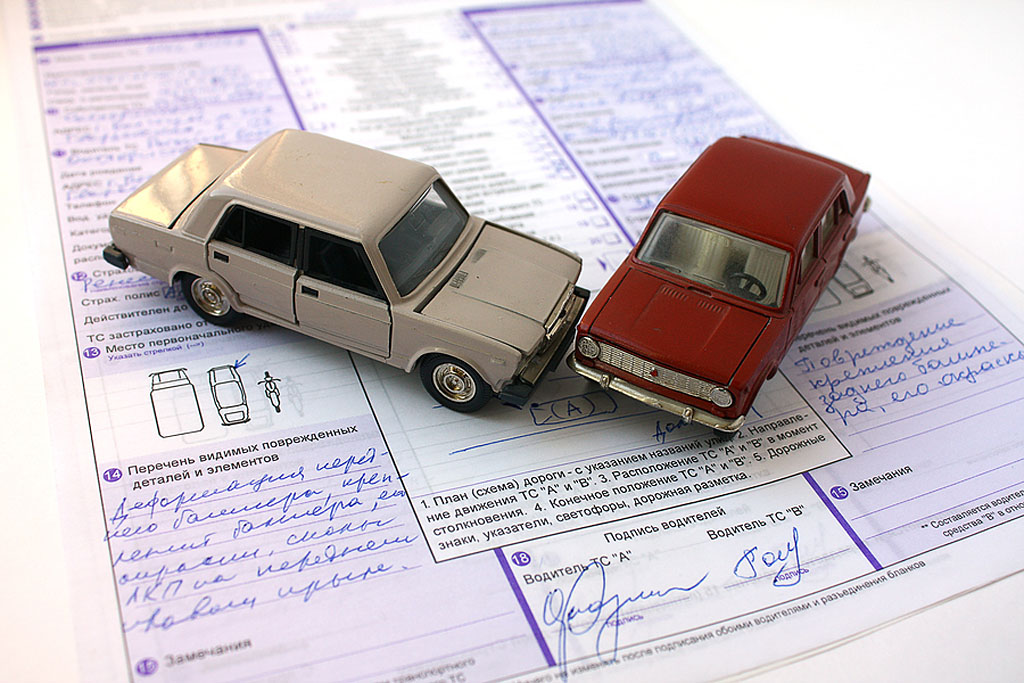

In Q3 2016, Armenian insurers concluded 287256 contracts, 10.2% more than in Q3 2015. As of 1 Oct 2016, the number of actual insurance contracts was 651370, with a 7.9% year-over-year growth. MTPL contracts retained leadership - 187.1 thsd in Q3 2016. As of 1 Oct 2016, the number of MTPL actual contracts totaled 433.2 thsd. As regards voluntary types of insurance, casualty insurance secured the biggest number of contracts - 36.1 thsd in Q3 2016. As of 1 Oct 2016, the number of actual contracts in casualty insurance was 113.8 thsd. By the number of MTPL contracts, Rosgosstrakh Armenia took the lead with 126.5 thsd contracts as of 1 Oct 2016, including over 57 thsd in Q3. RESO retained leadership in casualty contracts (79.3 thsd contracts as of 1 October, including 25.7 thsd in Q3). INGO Armenia concluded the biggest number of contracts in property insurance and insurance of those going abroad (as of October 1, 11.6 thsd and 5.3 thsd, respectively).

To note, 17 out of 19 classes of insurance are available in Armenia. INGO Armenia provides 16 classes of insurance, Rosgosstrakh Armenia - 15 classes, SIL Insurance, Armenia Insurance and RESO - 11 classes, and Nairi Insurance - 10 classes.