ArmInfo. According to the latest data, the share of small and medium- sized businesses in Armenia's GDP is about 25%. Meanwhile, in developed countries, this indicator usually varies between 50-60%.

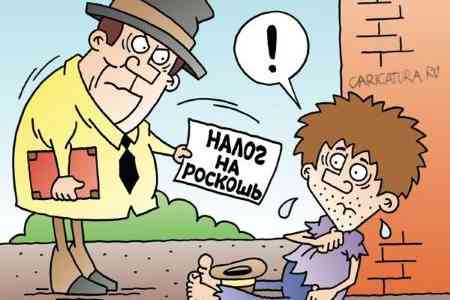

And instead of developing additional tools to support SMEs, the RA authorities are tightening conditions in the form of a double increase in the turnover tax rate with a further abandonment of the system as a whole. This says a lot about the attitude of the authorities towards the sector. President of the SME Cooperation Association Hakob Avagyan stated in a conversation with an ArmInfo correspondent. The expert recalls that micro, small and medium enterprises (MSMEs) account for 90% of enterprises, 60- 70% of employment and 50% of GDP worldwide. As the backbone of societies around the world, they contribute to local and national economies. MSMEs have the potential to transform economies, provide new jobs and drive equitable economic growth if given the right support. In 2018, the share of small-medium enterprises in GDP was estimated at 24% and in 2021, when Nikol Pashinyan's government approved its program of activities for the next 5 years, it set a goal to increase the figure to 55% by 2026, Avagyan noted. Then the RA Cabinet of Ministers pledged to take consistent steps to remove obstacles on this path. In particular, they promised to expand the tools for supporting SMEs for innovative entrepreneurs and increase access not only to finance, but also to skills, knowledge and connections.

In this vein, the SME community positively accepted the return to VAT-free y-o-y turnover through the turnover tax (replacing VAT and income tax) of up to 115 million drams from January 1, 2020 in Armenia. However, then the government decided to close regional SME Development Centers (for the first time since 2002). Now it has decided to double the turnover tax rate from October 2024, and to narrow the scope of beneficiaries of the micro-enterprise system from 2025. "On May 2 this year, the Cabinet of Ministers adopted a bill that concerns more than 55,000 business entities without proper discussion. At the same time, we have repeatedly signaled that such a key decision cannot be made based solely on official data - discussions should be held with focus groups, with representatives of SMEs in the capital and regions, since they have completely different problems," the head of the NGO emphasized.

Hakob Avagyan does not believe the assurances of the Ministry of Finance that for those who can document their expenses, the tax burden will not increase, but may even decrease. "Business does not like emotions. A number of areas would voluntarily take advantage of this provision, and it already exists, if they had such an opportunity. But, there are areas where the possibility of a tax deduction is actually impossible, for example, for resellers at the Meymandar food market or at the Malatya night market. In addition, as of today there are still goods, in particular from Turkey, that are imported into the Republic of Armenia through roundabout routes and that do not undergo proper customs clearance," he explained. In addition, the situation of small shops ,which can barely withstand competition with large retail chains that dictate the rules in the market, will worsen even more. "Shops in the regions, in conditions of a high tax burden and where it is initially impossible to fully document expenses, which are still trading "according to debt notebooks," will close or go into the "shadow," the expert noted.

Moreover, he noted, this revision also promises an indirect additional financial burden for business entities. If previously some small businesses conducted their own accounting, now they will have to resort to the help of a qualified accountant, which involves new costs. The legislative initiative will also hit the legal community of Armenia, Avagyan said. Thus, establishing a turnover tax of 10% of profits from October 2024, and introducing a general tax system, including VAT of 20% and income tax of 18%, starting in January 2025, will lead to a sharp increase in the tax burden on lawyers. "And we, ordinary citizens, will have to pay for this, since raising the rate will inevitably lead to an increase in the price of legal services by at least 30-40%," he noted.

Avagyan was also skeptical about the Ministry of Finance's expectations regarding additional revenues to the state treasury as a result of the adoption of the project in the form of an y-o-y increase in turnover tax revenues of approximately 17.8 billion drams. "That is only possible if this reform succeeds, and I argue that it will fail. This is not the first time such an attempt has been made, but unlike the current Cabinet of Ministers, the previous one entered into dialogue and abandoned "clumsy methods," he said. In this regard, the head of the Association noted, that the world has long come up with such a tool as assessing the impact of legislative acts. This tool allows you to assess the consequences of the new legal norm, based not only on the Ministry of Finance figures. They will find out what challenges resellers of agricultural products, importers and producers of raw materials, etc. may face. And after comparing and verifying all the data, the possible impact of the proposed initiative is derived.

"Unfortunately, we still have no idea what an alternative taxation scheme means for a start-up business, and the government does not ask the question of if it is so bad, why this scheme is still in effect in neighboring Georgia, and why a "simplified approach" for start-up businesses is maintained in developed countries, with a significant share of SMEs in GDP, " the SME Cooperation Association summarized.

Notably, currently turnover tax is paid by business entities whose y-o-y turnover does not exceed 115 million drams. This group includes SMEs, individual entrepreneurs and notaries. We are talking, in particular, about payments of 5% from the turnover of commercial activities and 3.5% from industrial activities. According to the Ministry of Finance, early research by the department indicated that two businesses engaged in the same activity find themselves in an unequal position - small and medium-sized businesses pay turnover tax, large businesses pay income tax and VAT. As a result, the effective tax paid by SMEs is 3-4%, and large businesses pay 2-2.5-fold more - 10%. As a result, taxpayers try to be and remain in this system at any cost, including hiding the real sales volumes, or dividing the business into parts, so as not to cross the value-added tax exempt threshold and to avoid the general taxation system.