ArmInfo.From September 9 to December 31, 2025, micro, small, and medium-sized business owners in Armenia can transfer their existing business loans to Ardshinbank and receive 5% of the refinanced amount as cashback. If you have loans from several banks, you can consolidate them into a single loan and then transfer it to Ardshinbank.

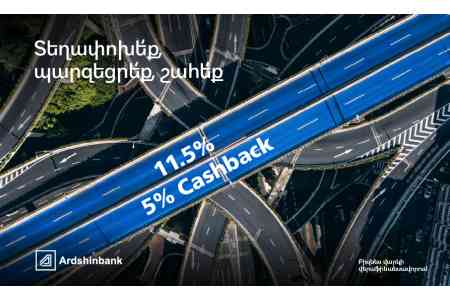

Refinancing with Ardshinbank gives borrowers access to the best interest rates in the country, 11.5% in AMD and 8.5% in USD. This will help reduce monthly loan payments, simplifies cash flow management, and provides additional funds that can be used at your discretion.

As noted by the bank, refinancing allows borrowers to combine multiple business loans into one. In practice, this means repaying loans taken from different banks under various terms with a new loan at a more favorable interest rate and a convenient repayment schedule.

Under this promotion, SME clients can refinance their business loans on the following terms:

Loan amount: minimum of 20 million AMD (or equivalent in foreign currency); maximum of 1 billion AMD (or equivalent in foreign currency)

Fixed annual interest rate: 11.5% in AMD, 8.5% in USD

Loan term: up to 120 months

Grace period: optional, up to 12 months for the principal amount

Cashback: 5% of the loan amount, paid immediately upon loan disbursement

Collateral requirement: the total loan amount cannot exceed 100% of the liquid value of the pledged real estate

You can apply for a loan at any Ardshinbank branch. For more information about the promotion, visit the Bank’s official website or call 012 22 22 22.