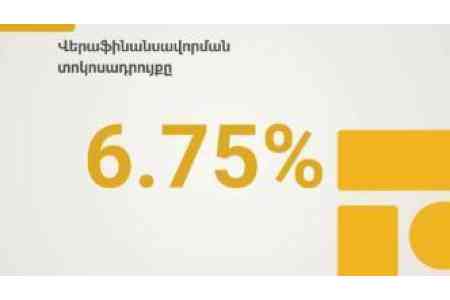

ArmInfo. The Central Bank of Armenia has once again decided to keep the refinancing rate at 6.75%. This decision was made on November 4 at a meeting of the Central Bank Board. This is the sixth time in 2025 that the Central Bank has kept the key rate unchanged. The first was made in March (following a reduction in February from 7% to 6.75%), followed by the following decisions in May, June, August, September, and this November.

Accordingly, the rates on Lombard repos (8.25%) and on deposits attracted from banks (5.25%) also remained unchanged.

In fact, after a 0.25 percentage point reduction in February 2025, from 7% to 6.75%, the refinancing rate has remained unchanged since then.

In total, from mid-2023 to February of this year (thereafter unchanged), the key rate was reduced by 4 percentage points (from a historical maximum of 10.75%). Accordingly, during this period, rates on Lombard repos and on deposits attracted from banks decreased by the same amount (by 4 percentage points) - from the maximums of 12.25% and 9.25%, respectively, recorded in December 2022 (and maintained until June 2023). However, for now, the current levels of the refinancing rate, Lombard repos, and on deposits attracted from banks are far from the minimum levels of 4.25%, 5.75%, and 2.75%, respectively, recorded in the second half of 2020.

According to statistics, inflation in September 2025 compared to September 2024 was 3.7%, compared to 0.6% in September 2024 compared to September 2023. The Central Bank's baseline annual inflation rate for September was 3.5%, compared to 0.7% a year earlier during the same period.

Central Bank Chairman Martyn Galstyan will present a detailed rationale for the Central Bank Council's decision to leave the refinancing rate unchanged at a press conference today at 2:00 PM. The press conference will also be broadcast online.

As a reminder, the Central Bank of Armenia, after raising the refinancing rate from a minimum of 4.25% to a maximum of 10.75% (i.e., by 6.5 percentage points) for 2.5 years (from December 2020 to mid-2023), began cutting the key rate starting June 13, 2023, continuing this policy in 2024 and early 2025 - in February, from 7% to 6.75%, maintaining this level to this day.

Starting in 2025, the inflation target is set at 3% with a tolerance of +/- 1 percentage point (versus the previous 4%, +/- 1.5 percentage points). The RA Law "On the State Budget of Armenia for 2025" stipulates that the Central Bank will henceforth be guided by this inflation target when making monetary policy decisions. Reducing the inflation target is an important prerequisite for implementing the joint approach of the Central Bank and the Government to ensure long-term stable economic growth and improved public welfare.