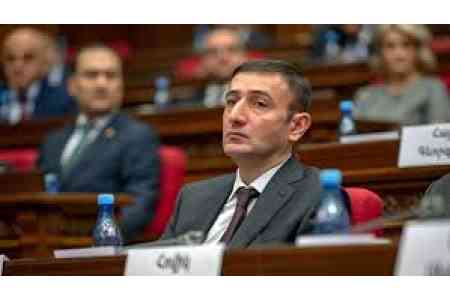

ArmInfo. New legislation on the taxation of the banking system will be developed in the near future, as stated by Babken Tunyan, deputy head of the Parliamentary Committee on Economic Affairs and member of the ruling "Civil Contract" faction, to reporters on February 5, while addressing the Central Bank's recent changes to non-cash payment commission limits.

During a press conference the previous day, Central Bank Governor Martin Galstyan announced the Central Bank's decision to cap commissions on retail trade payments starting March 1. The decision was made in response to numerous complaints by businesses regarding fees as high as 2-4% for non-cash transactions. "Starting March 1, the maximum rates will be 0.5% for the national ArCa payment system cards and 0.9% for international cards," Galstyan said, clarifying that the international payment systems Visa and Mastercard apply their own fees. According to him, the Central Bank took this step even though banks will suffer losses of approximately 2 billion drams, or approximately $5 million, as a result.

"I believe the banking system's high profits from the past and previous years will cover these losses. They are not obligated to do this, but we are grateful for their partnership," Babken Tunyan said. Regarding criticisms that banking services for businesses and individuals are unreasonably overpriced, Tunyan noted that while opinions vary, the government relies on market principles. "We proceed from the presumption that there are a large number of banks in Armenia and sufficient competition; if tariffs were unreasonably high, they would have decreased as a result of that competition," the parliamentarian concluded.

It should be noted that according to the analytical review "Armenian Banks in the Card Business" (Issue #32), prepared by the ArmInfo Investment Company, by October 1, 2025, there will be over 4.7 million cards in Armenia (with an annual growth rate of 9.1%): 770,300- ArCa cards, over 2.5 million- Visa cards, -1.1 million Mastercard cards, 148,200- AmEx cards, and 206,100 -other foreign cards (primarily MIR cards, and a small number of recently launched UPI cards). The total volume of plastic transactions for the first nine months of 2025 exceeds 5.5 trillion drams (including transactions abroad), with non-cash transactions already dominating the structure, accounting for 57%, or 3.2 trillion drams. Moreover, the share of online transactions among non-cash transactions is almost 48%, including transactions abroad, it exceeds 70%.