ArmInfo. The World Bank'55 mln USD Local Economy and Infrastructure Development Project (LEIDP) for Armenia will ensure a multiple return on investments within a short period of time, Armenian Economy Minister Artsvik Minasyan said at a

press conference on July 15, when asked by ArmInfo about the expediency to attract such a big loan for tourism development.

The loan project will be aimed at both rehabilitating the infrastructures and creating new jobs, the minister said. "After the funds are returned to the state budget, they can be spent on satisfying the country's needs in the field of defense," Minasyan

said.

The minister said the funds will be spent on infrastructure development near the southern (Meghri) and northern (Dilijan) borders of Armenia, which will ensure full-fledged trans-boundary tourism with Iran and Georgia. The project also implies rehabilitation of tourism infrastructures near Garni. The profitability of the project

will be quite high, Minasyan sais, adding that if the project is implemented effectively, it will be possible to speak of the recoverability in 5.5 years. He added that the project is based on the concept of development of local entities, which will ensure creation of new jobs and growth in budget revenues from the services sector.

In case of 5% annual growth, the number of tourists to Armenia is expected to grow to 1.600.000 by 2021. After 2021, following the effective implementation of the project, the profit is expected to amount to $100 mln, $24 mln of which will be transferred to the state budget. In case of 3 mln visits of travelers, the annual profit will total $3 bln ($720 mln to be transferred to the state budget).

On June 9, the Armenian Government approved the relevant loan agreement dated 23 Feb 2016. On Dec 22, 2015, the World Bank Board of Executive Directors approved a US$55 million loan for the Local Economy and Infrastructure Development Project (LEIDP) for Armenia to improve infrastructure services and institutional capacity for increased tourism contribution to the local economy in five selected regions of the country. The Project activities are expected to benefit the residents, tourists and enterprises in three marzes in the south - Ararat, Vayots Dzor and Syunik, and two marzes in the north - Kotayk and Lori.

More specifically, the first component - Heritage Hub Regeneration and Tourism Circuit Development - will finance urban regeneration activities in the old towns of Goris and Meghri, and in the heritage villages Areni, Tatev and Tandzatap. This includes restoration of public infrastructure, building facades and roofs, public spaces, museums, access roads, water and sanitation, drainage and street

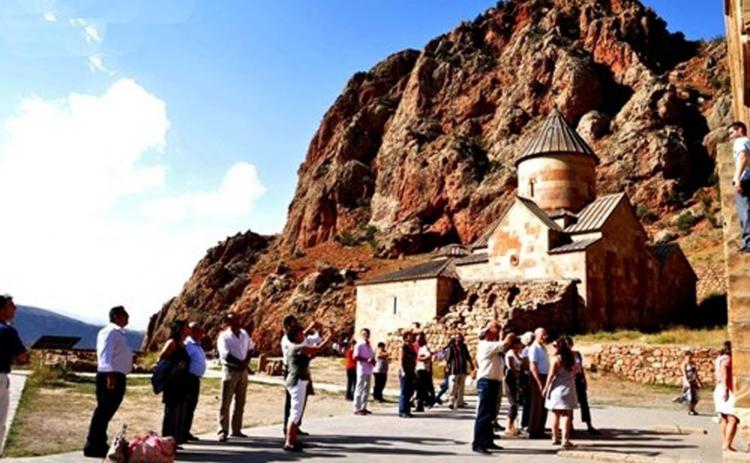

lighting. This component will also finance an integrated approach to cultural heritage preservation and improved site management plans of the most attractive cultural and natural heritage sites located along the main tourism circuit in Armenia: Garni (Temple and Gorge), Geghard Monastery, Dvin Museum, Khor Virap Monastery, Areni marketplace and cave, Mozrov cave, Zorats Qarer (Karahunge/Stonehendge), Khndzoresk and the two UNESCO Sites of Haghpat and Sanahin. The second - Institutional Development component - will increase the institutional capacity and performance of the Development Foundation of Armenia (DFA), the Ministry of Economy (MoE), responsible for overall coordination and policy support of the

Project, the Historical and Culture Heritage Protection Agency (HCHPA), and the Armenia Territorial Development Fund (ATDF), as the implementing entity, to carry out tourism related activities at the various levels in a sustainable manner.

The first year investment program will capture numerous activities for improvements at Khor Virap Tourism Facility; Garni Gorge with rehabilitation of 1.6 km road leading from Garni Temple to the Stone Symphony monument, located in Azat River Gorge; Zorats Qarer (Stonehenge) Tourism Facility with improvement of the road leading to

the monument. Total financing of this project is US$68 million, of which US$13 million will be the Government's contribution. The World Bank will provide a US$55 million IBRD loan of variable spread with a 14.5-year grace period and the total repayment term of 25 years.