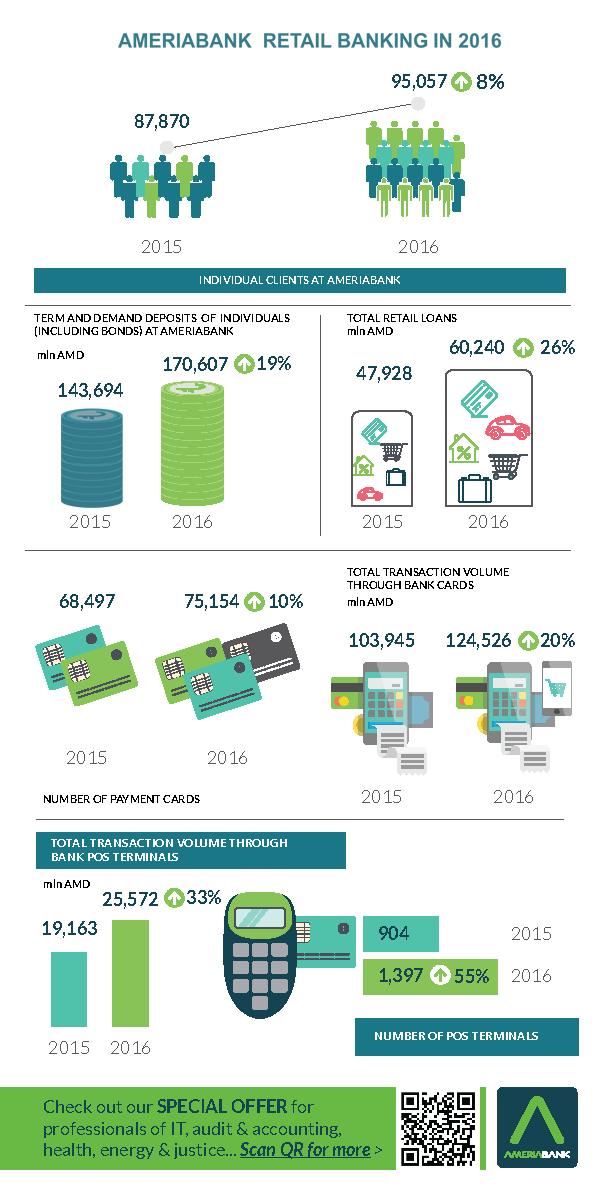

ArmInfo.Ameriabank strengthened its leadership in all the key indicators in 2016, accelerating the turnover of the retail business. As the press service of the Bank told ArmInfo, the deposits of physical persons (on-demand and urgent, including borrowing on bonds of the bank) increased by 19% in 2016 to 170.607 billion AMD, along with retail loans increased by 26% to 60.240 billion AMD.

The turnover of transactions on Ameriabank cards grew by 20% in 2016 to 124.526 billion AMD. The growth of the number of own POS-terminals by 55% up to 1397 units, increased the turnover of post- terminal transactions by 33% to 25.572 billion AMD. The number of plastic cards of Ameriabank increased in 2016 by 6.7 thousand units or by 10% up to 75 154 pcs.

The client base of Ameriabank increased in 2016 to 95057 customers from 87870 in 2015, in particular, the annual growth is 8%.

Ameriabank for the first time in the history of the Armenian banking system managed to achieve unprecedented volume of loans, which as of January 1, 2017 exceeded $ 1 billion. In 2016, Ameriabank was the leader in all key indicators: assets, liabilities, loan portfolio, deposits, profits and capital.

To note, "Ameriabank" CJSC is a universal bank that provides investment, corporate and retail banking services in the form of a comprehensive package of banking solutions. The bank has been operating in the Armenian market since October 31, 1996. The branch network of Ameriabank includes 12 divisions, 8 of which are in capital and 4 in regions. As of January 1, 2017, the Bank's shareholders are Ameri Group with 65.8% equity interest, EBRD - 20.7% and ESPS Holding Limited - 13.5%.